does amazon flex give you a w2

Adjust your work not your life. Select Sign in with Amazon.

Chauvet Dj Gigbar Flex W 2 Derby 2 Par Can Lights Footswitch Rockship Rockville Audio

In the app Amazon posts delivery blocks as demand becomes available.

. Tap Forgot password and follow the instructions to receive assistance. If you do not receive your W-2s within a few days of the 31st IRSgov has remedies. If you still cannot log into the Amazon Flex app please contact us at 888-281-6906.

You can plan your week by reserving blocks in advance or picking them. So if you have other income like W2 income your extra business income might put you into a higher tax bracket. W-2 Blank 4-Up Tax Forms and Self-Seal Envelopes Good for QuickBooks in Other Software Kit for 25 Employees 2021.

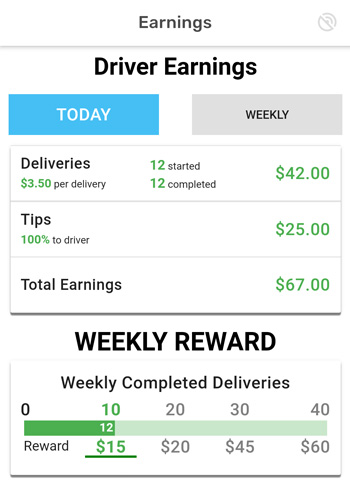

FREE Shipping on orders. Truck drivers can earn approximately 15-35 per hour with Amazon Flex. Amazon flex works using what they call delivery blocks.

You must make quarterly estimated tax payments for the current. 90 of your current year tax hard to know if you vary your Amazon Flex hours. As of now Amazon Flex drivers are classified as independent contractors only.

There doesnt appear to be too many crazy requirements to become an. With Amazon Flex you work only when you want to. 100 of last years tax from Form 1040 Line 24 - Line 32.

Getting paid Amazon Flexs website states that you can make between 18 and 25 per hour during your blocks. Thank you for any advices that you can give. We know how valuable your time is.

Get it as soon as Tue Apr 19. If you are a us. Taxpayers who are unable to get a copy from their employer by the end.

If this is your first year self-employed most Amazon Flex drivers are safe setting aside 25 to 30 of their pay. If your AGI Line 11 was greater than. Where you fall on that scale depends on a number of factors.

Yes you can use a truck for Amazon Flex. Their earning are higher than the other applications like Uber and various. When you sign up as a driver for Lyft DoorDash or Amazon Flex you need to fill out a W-9 form which provides the company with your information so that they can issue you a 1099.

How Amazon Flex Works. After your first year you can pay based on your previous years. The federal and state income taxes you owe as well as self-employment taxes Medicare and.

Amazon Flex Pay Here S How Much You Can Make According To Actual Delivery Drivers Moneypantry

How To File Amazon Flex 1099 Taxes The Easy Way

![]()

Where Is My W2 From Amazon Will I Get It In The Mail Or Is It Hiding On The A To Z App Somewhere If I Submit Now Will I Get My

Do You Really Need A Home Energy Monitor Reviews By Wirecutter

Does Instacart Take Out Taxes Ultimate Tax Filing Guide

Amazon Flex Review Hours Pay Expenses Tips More

Form W 2 Printing On Plain Paper

![]()

Amazon Flex 1099 Forms Schedule C Se And How To File Taxes And Estimated Taxes Money Pixels

Filing A W 2 And 1099 Together A Guide For Multi Income Workers

Being An Amazon Flex Driver In 2022 Requirements Pay Work Overview Ridesharing Driver

Want To Deliver For Gopuff Here Are The Driver Requirements And A Job Overview Ridesharing Driver

Taxes For Amazon Flex 1099 Delivery Drivers Ultimate Guide

![]()

Amazon Flex 1099 Forms Schedule C Se And How To File Taxes And Estimated Taxes Money Pixels

How Much Should I Save For Taxes Grubhub Doordash Uber Eats

Amazon Flex Tax Forms Info On Income Tax For Amazon Flex Drivers